DEBT INVESTORS

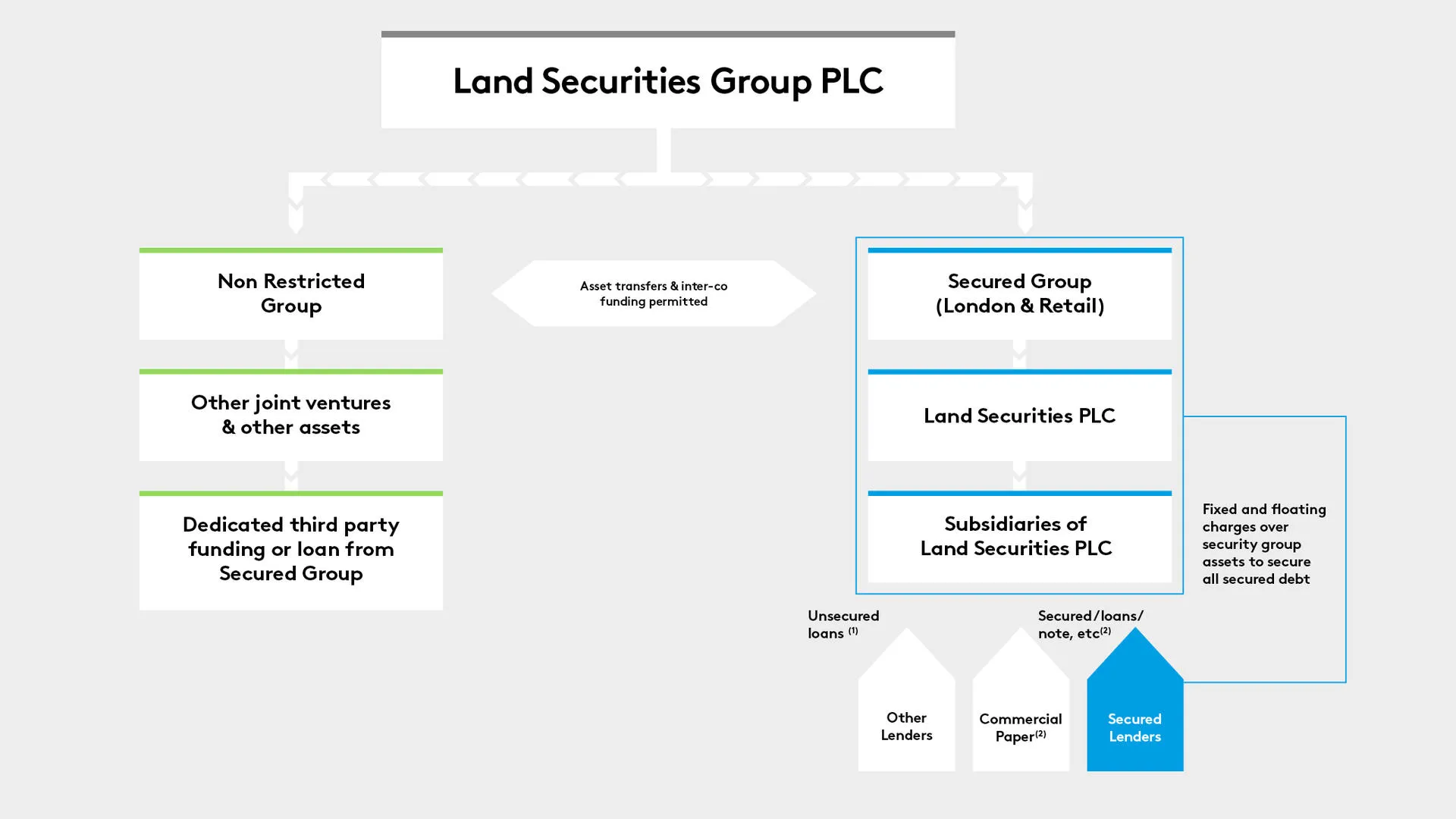

Our corporate debt structure gives us maximum operational and financial flexibility. Within it, our business is divided into two parts.

On one side, there's our Security Group. This is our main funding vehicle. It borrows from secured lenders and uses Commercial Paper for short-term loans. It borrows unsecured loans, but only up to a certain limit. The Security Group gives debt investors security over the majority of the properties in our Portfolio.

Separate to this is our Non-Restricted Group. This covers other properties such as joint-venture holdings and certain other assets. Because this group sits separately, we can finance certain assets without affecting the credit rating of debt issued by the Security Group.

Our tiered covenant regime

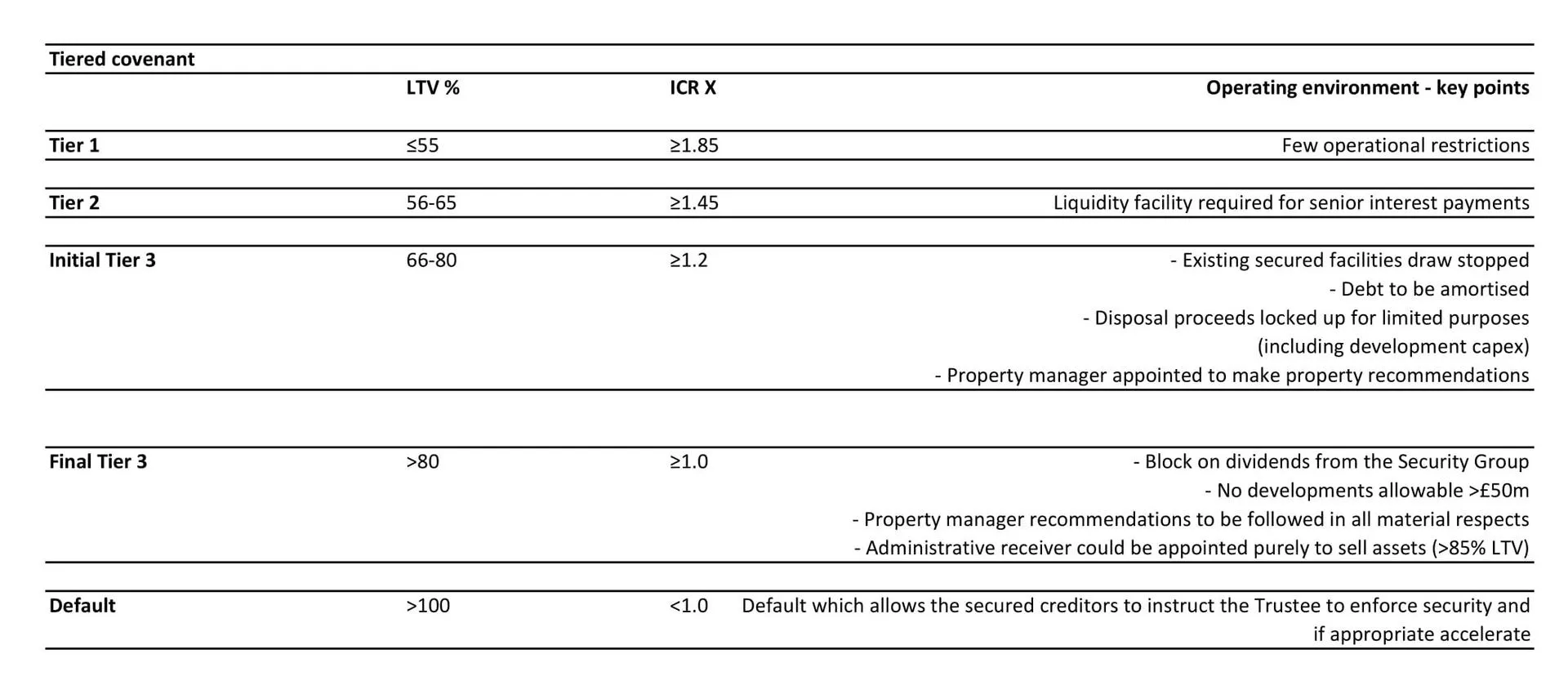

We use a tiered covenant regime. This gives us the flexibility we need to run our business, while protecting investors if gearing increases significantly.

Whenever loan-to-value is less than 65% and the interest cover ratio is more than 1.45, we keep a lot of operational flexibility. But if this changes, we start to put operational restrictions in place, these act as an incentive to reduce gearing.

Different classes of debt

We can borrow different classes of debt. These are prioritised in terms of payments and security. We can offer Priority 1 debt, Priority 2 debt, subordinated debt and unsecured debt.

To give Priority 1 investors some protection, we only issue Priority 1 debt up to 45% loan-to-value. Debt supported by the next 10% of loan-to-value must be switchable, and able to migrate between Priority 1 and Priority 2 depending on various financial tests. If this isn't the case, and there isn't enough switchable debt to bring the remaining Priority 1 debt below 55%, any excess will be progressively collateralised.

Full details of our notes and bond debt are set out in our Base Prospectus: